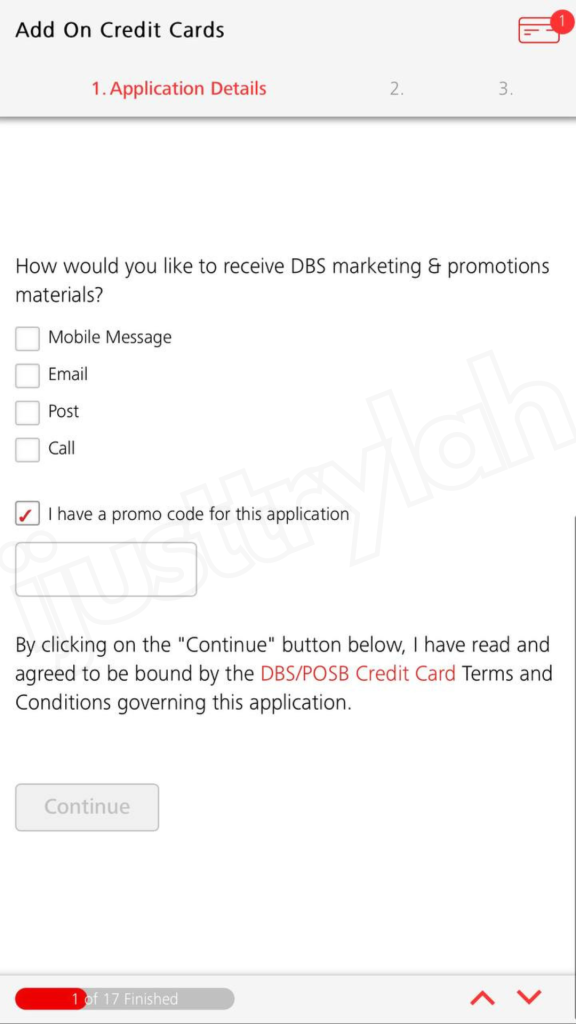

DBS Altitude Sign Up Promotion:

AMEX:

- Up to 38,000 miles with annual fee payment (Promo Code: ALT38)

- Up to 28,000 miles with annual fee waiver (Promo Code: ALTW28) (I would recommend this!)

- must spend S$800 within 60 days from card approval date

- Valid for New DBS/POSB credit cardmembers only

- Not stackable with other DBS/POSB offers

- Valid until 30 April 2025

- Must fulfill spending requirement to receive gift confirmation

- Read Terms and Conditions here

DBS Altitude Card Overview:

- Love to travel? This might be the best card for you! The miles never expires so you can take your time to accumulate your precious miles! You can earn up to 2.2 miles per S$1 on retail spend, earn up to 1.3 miles per S$1 local spend.

Local Earn Rate | 1.3 miles per dollar |

Foreign Currency Earn Rate | 2.2 miles per dollar |

Foreign Currency Fees | 3.25% (VISA)3% (AMEX) |

Min. Miles Transfer | 5,000 DBS Points (10,000 miles) |

Transfer Fee | S$27.25 (inclusive of GST) |

Points Pooling | Yes |

Lounge Access | Yes (only for VISA version) |

Airport Limo | No |

Points Expiry | No Expiry |

Eligibility & Fees:

- Minimum Age: 21 years old

- Minimum Annual Income: S$30,000 (locals/PRs); S$45,000 (foreigners)

- Annual Fee: S$196.20 (inclusive of GST), first year waived

Key Benefits:

- Earn 1.3 miles per dollar (3.25 DBS Points per S$5) spent locally, including bus and train rides

- Earn 2.2 miles per dollar (5.5 DBS Points per S$5) spent on overseas purchases in foreign currency

- No minimum monthly spending required

- No maximum spending cap

- Since points are earned for every S$5 spent, a $4.99 purchase will not earn you any points.

How to Best Optimise it:

- This card is a general spending card, so you can use it anywhere except anything on the exclusion list. The best way is to use it for local spending. This might not be a great card to use overseas. You are better off using another card with higher earn rate.

- Since points are earned for every S$5 spent, avoid using this card on transactions below S$5

- For overseas spend, you must take note of the foreign currency fees of 3% (AMEX) and 3.25% (Visa)

- The Visa version comes with two complimentary lounge passes per 12-month membership period. Take note that it is not by calendar month. The value of a priority pass is around $35, so you’re getting twice the value just by having this card! As a principal cardmember, you can either have two separate lounge passes for yourself or you can use two passes by bringing one guest along the same visit! (Guide on how to apply for the priority pass HERE). Unused passes will not carry forward to the following 12-month period. So it is best to utilise it when you are taking budget flights out of Singapore.

- On your 2nd year renewal, you can receive 10,000 bonus miles when you pay the annual fee of S$196.20 – this makes the cost per mile 1.96¢ per mile which is quite high! It’s expensive so i would skip paying the annual fee, and get the annual fee waiver instead

What to Avoid:

Exclusion List:

MCC | Description |

4784 | Toll and Bridge Fees |

4829 | Money Transfer |

4900 | Utilities – Electric, Gas, Water, Sanitary |

6010 | Financial Institutions – Manual Cash Disbursements |

6011 | Financial Institutions – Automated Cash Disbursements |

6012 | Financial Institutions – Merchandise, Services and Debt Repayment |

6051 | Non-Financial Institutions – Foreign Currency, Liquid and Cryptocurrency Assets, Money Orders (not Money Transfer), Account Funding (not Stored Value Load), Travelers Cheques, and Debt Repayment |

6211 | Security Brokers/Dealers |

6300 | Insurance Sales, Underwriting, and Premiums |

6381 | Insurance Premiums |

6399 | Insurance, Not Elsewhere Classified |

6540 | Non-Financial Institutions – Stored Value Card Purchase/Load |

7523 | Parking Lots, Parking Meters and Garages |

7995 | Betting (including lottery tickets, casino gaming chips, off-track betting, and wagers at race tracks) through any channel; |

8062 | Hospitals |

8211 | Elementary and Secondary Schools |

8220 | Colleges, Universities, Professional Schools, and Junior Colleges |

8241 | Correspondence Schools |

8244 | Business and Secretarial Schools |

8249 | Vocational Schools and Trade Schools |

8299 | Schools and Educational Services (Not Elsewhere Classified) |

8398 | Non-profit Organisations |

8661 | Religious Organisations |

9211 | Court Costs, Including Alimony and Child Support |

9222 | Fines |

9223 | Bail and Bond Payments |

9311 | Tax Payments |

9399 | Government Services (Not Elsewhere Classified) |

9402 | Postal Services – Government Only |

9405 | Intra-Government Purchases – Government Only |

AMAZE* | AXS BizPay* | AXS PTE LTD* |

BAGUS* | CANTINE* | EZLINK* |

EZ-LINK* | PAYPAL *AXS PTE LTD* | RAZERPAY* |

SAM -* | SAM PAYMENTS* | SEDAP* |

SGEBIZ* | SHOPEEPAY* | SINGAPORE E-BUSINESS* |

SINGTEL DASH* | TRANSIT 3* | YOUTRIP* |

This is not an exhaustive list and are subject to changes from time to time.

Transfer Partners:

Here is the list of their current transfer partners:

Transfer Partners | Conversion Ratio |

Krisflyer | 5,000 : 10,000 |

Asia Miles | 5,000 : 10,000 |

Frequent Flyer | 5,000 : 10,000 |

AirAsia | 500 : 1,500 |

Is it Worth it:

- Points earned on this card has no expiry, therefore you can take your time to accumulate miles

- 2 free lounge visits comes with the Visa version for every 12-month membership year, whether or not you pay the annual fee!

- Can pool points with other DBS cards— pooling means that if you have points on your DBS Altitude Card and you have points on other DBS credit card such as the DBS Woman’s World Card, then you can consolidate them and transfer them to a frequent flyer program with a single conversion fee. Other banks that do not pool points will require you to pay a conversion fee for each points transfer on each card.

- Low miles earn rate (but it gives you miles that do not expire)

Frequently Asked Questions:

- When will the DBS Points be credited on account: This usually credits when the transaction posted, usually takes 24 hrs or in some, it could take 2-3 days.

Final Thoughts:

- With the recent update of increase in miles earned, it makes the earn rate more attractive than the Citi Premier Miles. If you are a working young adult fresh out of school, this is a good card to accumulate points through your daily expenses, without the pressure of spending and miles expiring. You can definitely take your time to plan your trips and go out of the country anytime may it be spontaneous or grand.

Credit cards change their T&Cs every so often and it is difficult to stay updated. That’s why I created a Telegram Broadcast where you can receive timely bite-sized updates to get the most out of your spending.

DBS Altitude Sign Up Promotion:

AMEX:

- Up to 38,000 miles with annual fee payment (Promo Code: ALT38)

- Up to 28,000 miles with annual fee waiver (Promo Code: ALTW28) (I would recommend this!)

- must spend S$800 within 60 days from card approval date

- Valid for New DBS/POSB credit cardmembers only

- Not stackable with other DBS/POSB offers

- Valid until 30 April 2025

- Must fulfill spending requirement to receive gift confirmation

- Read Terms and Conditions here

We believe in always paying our credit card bills on time and in full. It is only by doing that, can we fully maximise our credit card benefits.